im Gespräch mit ... Erik Podzuweit Scalable Capital #Fintech #Banken #Startup

Das Thema Fintech ist sehr aktuell. Damit auch im Fokus des Startup Events Web Summit 2015.

Eine Gute Gelegenheit ein Gespräch mit einem der Gründer von Scalable Capital, Erik Podzuweit, zu führen. Das Startup bietet einen Service in der Vermögensverwaltung, der bisher nur professionellen und sehr reichen (HNWI) zugänglich war.

Neben der Lösung, der Gründung, der Finanzierung durch VCs und dem Geschäftsmodellwar auch Zeit über die Situation der Banken und den Herausforderungen durch Digitalisierung und Fintechs zu sprechen.

Viel Spaß beim Anschauen, dieser Liveaufnahmen direkt vom Event.

Wer sich für Scalable Capital und die Dienstleistungen interessiert kann sich über:

https://de.scalable.capital/ oder Diese E-Mail-Adresse ist vor Spambots geschützt! Zur Anzeige muss JavaScript eingeschaltet sein! informieren.

4 weeks after the Web Summit 2015 - a review and takeaways about the European innovation & startup ecosystem SaaS part 1

This is part I of the review of this year's Web Summit in Dublin. Four weeks passed (intentionally) and with some distance it is now time to ask what remains and what facts are of importance from all the insights into start-ups technology and the ecosystem.

A first judgement

What sticks four weeks after the event is best described as a strange mix of "being overwhelmed by information" and "nothing new". It does not mean it was no great event. It was, but the above impression remains. This result is a confirmation of Iceventure's current view of the innovation and startup ecosystem in Europe which is moving more in the later stage of the cycle.

What sticks four weeks after the event is best described as a strange mix of "being overwhelmed by information" and "nothing new". It does not mean it was no great event. It was, but the above impression remains. This result is a confirmation of Iceventure's current view of the innovation and startup ecosystem in Europe which is moving more in the later stage of the cycle.

Why the Web Summit confirmed it and the arguments for this assessment are laid out in the following.

About Web Summit 2015 itself

First, some remarks about the event itself. This year's Web Summit brought about a lot of discussion prior to the event asking

Finanzdienstleistungen im Zeitalter der Digitalisierung und Fintech - Sind Banken Vergangenheit und die Zukunft des Finanzsektors Digital?

Wir freuen uns auf den Termin

DIGITAL IS CHANGING EVERYTHING. SIND BANKEN TRADITION UND DIE ZUKUNFT DES FINANZSEKTORS  DIGITAL?

DIGITAL?

am 25.11.15 um 18:30 Uhr hinzuweisen.

In der spannenden Podiumsdiskussion, organisiert von dem Juniorenkreis des Exportclub Bayern, geht es um das Thema Finanzdienstleistungen und Fintech.

Arnbjörn Eggerz von Iceventure wird die Moderation der Runde übernehmen.

An der Diskussion werden teilnehmen:

The State of European Fintech according to participant data for Web Summit 2015

After digging into the software as a service data provided by the Web Summit team I was of course also very interested to examine the data about the participating Fintech start-ups. Therefore, I took some time last night to look into it, providing some of the insights here.

A snapshot of the European Fintech space (participating in Web Summit)

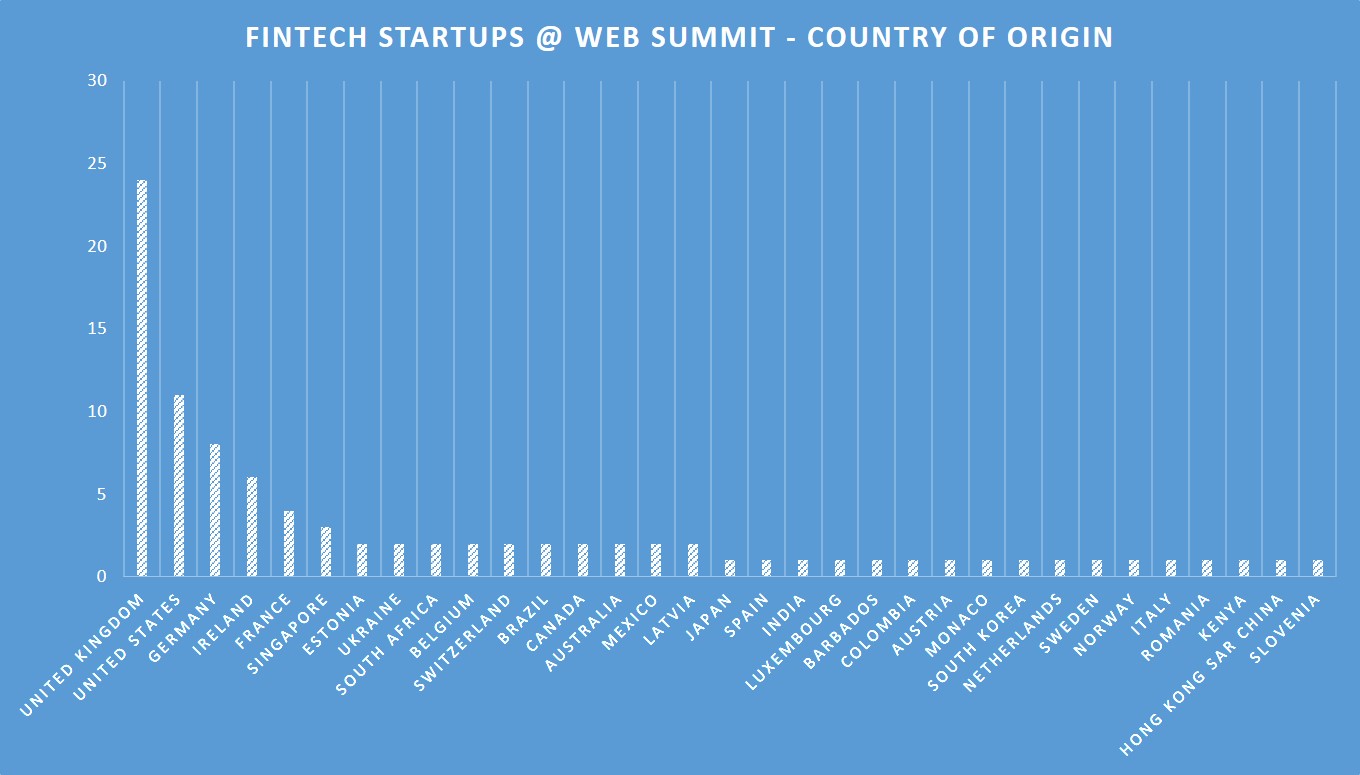

First, I describe the data set available: 93 startups are listed in this segment of Fintech out of 2081 start-ups in total. This means about 4.7% of participating start-ups are in Fintech. 61% are European Fintech start-ups meaning 2,74% of all participants.

The number might be a bit sobering seeing the number of 2000+ start-ups and the currently generated media hype about Fintech. I do not have a particular interpretation of the low number of the 4.7% as with in the case of SaaS, but guess it also has to do with the fact that financial services are extremely competitive with demanding domain knowledge.

Distribution - Fintech start-ups per country

Now the distribution of the Fintech startups per country. Prior to citing the numbers, I lay out some expectations. For Fintech, I would not expect Germany to be leading in Europe, while I would expect to find many Fintech startups from the  traditional financial centers of Europe like UK, France, Italy and Luxembourg. I think this is a valid expectation as

traditional financial centers of Europe like UK, France, Italy and Luxembourg. I think this is a valid expectation as

The state of European SaaS according to participant data for Web Summit 2015

Yesterday evening I had the chance to take a first look on data the Web Summit databases provides for participants. I took some time to dive in deeper into one of our sectors - software as a service in (SaaS). Of course, one has to keep in mind that the data from the Web Summit is not fully representative as there is the conference participant bias. But I think it still provides a good general snapshot about the state of SaaS in Europe and Germany. This article will walk you through to some numbers and important insights you can derive from that.

A snapshot of the European SaaS space (participating in Web Summit)

First a general description of the data: There are 72 SaaS companies out of 2083 startups that included the term SaaS or software as a service in their description. This is a rate of only 3.5%.

It might come as a big surprise for many used to the slogan "SaaS is everywhere and the future", and given it is an exclusively web conference. I think it fairly reflects the fact that - albeit SaaS is a very interesting business model - it is also a very demanding place for startups to be. And I am not even talking about the king's class, which is enterprise SaaS.

Are current SaaS Vendors already Legacy Dinosaurs?

About two years, there was a very interesting post by Robert Desisto, the head of Gartner's SaaS practice about the saas business model.

He formulated a hefty critique of the current sales policies of mostly big SaaS vendors for the business and enterprise customer segment. He ended with the question if these vendors could indeed already be "dinosaurs".

A recent pricing strategy discussion with clients, reminded me that it is still a current topic. Thus, I post the comments on this SaaS sales question with a European view (slightly updated and this time in English).

His critique of the SaaS vendors

The reason for his statement is the practice to close long-term contracts with a fixed usage/license volume. This of course kills the main advantage and argument for SaaS in contrast to the classical on premise license sales "pay only for your real usage in a given timeframe". He also mentions that the typical quarter sales thinking has not changed. Therefore, Desito concludes "SaaS sales agents act like their on-premise colleagues."

The reason for his statement is the practice to close long-term contracts with a fixed usage/license volume. This of course kills the main advantage and argument for SaaS in contrast to the classical on premise license sales "pay only for your real usage in a given timeframe". He also mentions that the typical quarter sales thinking has not changed. Therefore, Desito concludes "SaaS sales agents act like their on-premise colleagues."

As expected, the article drew a wide response. Thus, one could think that this should translate into an untapped potential for new SaaS startups or disruptors, meaning that the current vendors - themselves just grown-up to the new stars of software corporates - would be obsolete soon. And not much changed since.

An untapped opportunity for startups or business model innovation?

You have to take the statement with a grain of salt.

Firstly, it is a fully valid strategy for SaaS vendors and for SaaS startups to close long-term contracts. This is for the fact that this business model is cash intensive and such sales practices stabilize the much-needed cash flows, especially when you think of the necessary VC financing. This happens often by discounts, which you trade off for flexibility. This is the problem of all SaaS companies. Therefore, each new market entrant that wants to gain market share via playing the "only pay-as-you-go variable" has to face the same cash problem and needs a solution to it.

Zukunft Elektromobilität - kann Innovationsgeschichte neue Lösungen aufzeigen?

Die eCarTec ist eine gute Gelegenheit die aktuelle Zulassungsstatistik von Elektroautos auf deutschen Straßen zu kontrollieren.

Die reale Situation der Emobilität in Zahlen

Die exakte Zahl ist 18.948. Dies ist im Vergleich zu den 7.114, die wir vor zwei Jahren zählten, als wir den ersten Workshop auf der eCarTec zum Thema „Rethink E-Mobilität – alternative Wege denken" angeboten haben, ein beachtlicher Fortschritt.

Die exakte Zahl ist 18.948. Dies ist im Vergleich zu den 7.114, die wir vor zwei Jahren zählten, als wir den ersten Workshop auf der eCarTec zum Thema „Rethink E-Mobilität – alternative Wege denken" angeboten haben, ein beachtlicher Fortschritt.

Allerdings ist diese Zahl immer noch um 981.052 Autos von dem 1 Million Ziel der Bundesregierung und Industrie bis 2020 entfernt. Zudem ist diese Anzahl, umgelegt auf alle Automobilhersteller und deren Stückzahlanforderungen an eine Serie, als reine Handarbeit einzuordnen.

Nun ist an Ideen und Vorschlägen kein Mangel, wie das zu ändern wäre.

Der wohl am häufigsten geäußerte Ratschlag ist die Subventionierung d.h. ein Eingriff von staatlicher Stelle.

Aus Sicht des Innovationsberaters allerdings sind diese Vorschläge der falsche Ansatz. Denn bevor man etwas verbessern kann, ist eine saubere Analyse des Problems und seiner Ursachen vorzunehmen.

Aus Sicht eines Innovationsexperten war dies eine vorhersehbare Entwicklung

Die Frage, die wir uns gestellt haben, ist also ob diese Entwicklung des E-Autos von vorneherein so zu prognostizieren gewesen ist. Die Antwort darauf ist ja. Entscheidend ist allerdings zu verstehen, warum wir zu dieser Aussage kommen. Denn diese ist in keinster Weise in einer Ablehnung der Technologie oder durch ein Festhalten am Status quo begründet. Die Einordnung erfolgt rein durch das Bewerten der Innovation E-Auto in dem aktuellen technischen und sozio-ökonomischen Kontext und basierend auf Innovationsgeschichte und Forschung.

the Web Summit scam debate - Thoughts on how to choose startup-events and why we go there

Right after publishing the blog post that I will participate in this year's Web Summit 2015 in Dublin I got a couple of requests by our startup clients. They in particular asked two questions:

• Why I break the rule, I preach all the time not to attend startup events?

• When breaking the rule why then by going to Web Summit, the event accused of being a scam?

The disclaimer:

Before continuing this article, I have to give a full disclaimer: I have been invited by the Web Summit team to do media coverage, especially on Fintech covered in the Money Summit.

There is no other affiliation nor have I been asked to publish an article about the allegations.

I have never been to Web Summit before, although I know the conference since its beginning, so I cannot give you a first-hand insight about participation in the past.

Still I deem it important to write about the subject matter as it is discussed also in Germany and it is a perfect occasion to illustrate some insights that are valuable for our readers, startups and (not yet) clients in general.

Valuing information quickly - the scam critique on Web Summit

The first insight is about how to evalue the fraud allegations on a general level as such situations repeat over time.

There is so much information – and (emotional) opinion snippets (aka Shitstorm) in the web that the first thing you need is a quick technique with which you can assess information in a very short time (the business case for structured feeds).

A simple, but effective way I found over time – albeit not being perfect - is to check the volume of reaction e.g. in form of comments. The danger is to overvalue emotional reactions leading to many comments (or good social media teams commenting) as they can be very far removed from reality, but it is one indicator.

With 55 and 12 comments on the relevant articles on Tech.eu you get the impression that the problem cannot be as huge compared to about 20000 participants in 2014

A second indicator is that most people preferred to remain anonymous. In this case, it is strange because it should not be a problem to tell your story when others did so openly. What do you have to lose as a start-up when you speak out against an event? They might not invite you or sell you a ticket in the future - so what? They are not your customers, nor your investors. And once you are in the unicorn club, they will invite you in any case. If not invited then, it is still a great media story, so why care.

Then there was another sentence in one article that caught my attention:

Iceventure goes Web Summit 2015 – start-ups interview/presentation opportunity

Arnbjörn Eggerz, managing director of Iceventure, will participate in this year's Web Summit.

There will be a follow-up post on the why and pros and cons, while this post is about my focus for this event: What is it, I like to discuss with participants and what are the insights for our clients I will collect as part of our business intelligence activity.

About the Web Summit and our participation

About the Web Summit and our participation

Web Summit is a rather large event with about 30.000 participants and over 1000 speakers. It grew to this dimension in about 5 years.

The sheer number of participants makes it a very interesting place to catch the sentiment of the European start-up and innovation for our clients, with the side fact of an invitation by Web Summit to do media coverage on the Money Summit. So thanks a lot to the Web Summit team for inviting me!

There are up to 21 Mini Summits -all of course interesting - out of which I decide to focus on these:

Fintech

Fintech is a sector that got more and more attention. With all the enthusiasm, we deem it however necessary to put things in a perspective. With persepctive I mean to change focus from an individual tech solution to an overall sector outlook in the current context of banking.

One perspective is the combination of Fintech innovation with ongoing sector trends in the banking crisis as explained in the Tradeshift post or the valuation of Plan B laid out by Mr. Varoufaksi.

A second important perspective is Fintech innovation versus the implosion of banking due to e.g. the Euro crisis.

Why the Euro crisis continues, Germany and German banks are at risk and the link to innovation and Startups Update 102015

Iceventure received a couple of questions over the summer concerning the analysis of the Euro crisis and the coverage of Greece.

In particular, three critiques have been formulated:

a) Why continue to keep the Euro crisis on the radar as even the "rebellious" Greek Prime Minister Tsipras committed on the mainstream Euro politics and reform agenda and all have only to work on agreed solutions?

a) Why continue to keep the Euro crisis on the radar as even the "rebellious" Greek Prime Minister Tsipras committed on the mainstream Euro politics and reform agenda and all have only to work on agreed solutions?

b) Why such an appealingly tough stance on Germany as it is one of the best performing countries in the Eurozone especially with the start-up revolution finally also taking place here?

c) Why combining the Euro crisis with innovation and start-ups?

This post is only providing short answers as we are preparing, based on business intelligence work for customers, an updated analysis on the Euro crisis after the new Greek agreement.

Still I deem it important to provide some general comments prior, as we find the main thesis of a major structural change more and more confirmed.

Greece has its part, but is only a puzzle piece in the Euro crisis

First, even with this summer's Greek agreement I do not find any of the Euro issues as a currency area fixed. It is still a dysfunctional currency area with the ECB taking over a political role and a reform debate towards federalism starting only now.

This is the second dominating issue and from market view and realities years away in terms of speed of crucial reforms (as outlined here). Albeit Greece has its role and one can illustrate many Eurozone issues exemplarily, the bigger picture did not change. This issue will stay on the table even with a Grexit which likelihood did not significantly change with the new agreement.

In the meantime, it is interesting to use OCA theory for analysis and compare the Eurozone to the U.S., but we should treat the Euro as it is without the reforms: It is a fixed currency regime either turning into a currency area or falling apart.

Then, as I continue to argue, we deal not primarily with a currency crisis, but with a profound government debt and banking crisis that is amplified in an ill constructed currency area.