The difference between Growing Vs Scaling a business

Let's begin with the basics: what is the difference between business growth and scaling?

Essentially, growing a business is about getting bigger, while scaling up a business is about handling growth efficiently. Business scaling involves increasing a company's capacity for growth, requiring a longer-term strategy than merely focusing on immediate expansion. This understanding diffuses today also in research. Hence, according to Jansen et al. (2023), "Scaling is the organizational and strategic routines by which firms grow exponentially through the expansion, replication, and synchronization of resources and practices over time."

Scaling: what does it mean in practice?

In the day-to-day operations of our consulting work, we've identified three distinct scenarios commonly referred to as scaling (e.g. you’ll hear “company X is scaling”), though each is unique:

- Preparation Phase: This scenario involves a startup or an established company planning its growth trajectory and preparing for scaling. These companies are gearing up to expand by setting strategic foundations that will support larger operations.

- “Active” Scaling Phase: Here, a company is in the midst of scaling. Its activities and market engagements result in significant increases in resources and business functions.

- Transition Moment: the phase in which the planned growth is realized, but almost every time comes as a surprise and requires a new resource deployment for startups.

Let’s discuss some aspects of the first situation – companies planning to scale. Typically, many think only of the latest high-tech companies. However, in our experience, this is not the case; many types of companies scale. Thus, we will explore what the case studies show beyond our experience.

Scaling Success Stories: Learning from Europe's High-Growth Firms

Factors such as a company's age, business model, and technology intensity can significantly affect the pace and intensity of growth. While it's common in executive circles to aspire to become the “Uber of” a particular industry or to strive to be “more like Airbnb,” these ambitions don't always pan out as expected. Nonetheless, studying successful scaleups can provide critical insights for developing your own growth strategy.

The collaborative European Scaleup Monitor, now in its second edition, provides the latest trends in European scaleups and high-growth firms (HGFs) across Europe, revealing the diverse growth paths these organizations have taken. The 2023 edition of the European Scaleup Monitor featured several valuable examples of successful scaleups:

- Let’s start with Glovo, the renowned Barcelona-based technology unicorn. Glovo rapidly expanded into over 1500 cities worldwide and forged strategic partnerships with giants like McDonald’s and Carrefour. This meteoric rise was driven by a highly scalable tech platform, a relentless pursuit of growth (often referred to as blitzscaling), and the strategic use of online-to-offline (O2O) partnerships, which created powerful local network effects. Glovo's success underscores the importance of a robust technology infrastructure and aggressive market expansion strategies.

- De Lift, a Belgian company specializing in elevator maintenance, offers a different perspective. Active in a traditional, non-tech industry, De Lift achieved consistent 40% growth in employees by focusing on regional coverage and efficient size. By reaching a critical mass in terms of employee numbers and regional presence, De Lift was able to sign larger clients and provide comprehensive maintenance services. This example illustrates that in service-oriented industries, scaling often hinges on delivering superior service and achieving operational efficiency.

- On the high-tech front, nCore, an Italian scaleup, developed an all-in-one digital recruiting platform leveraging AI and machine learning. nCore's focus on process management and internationalization allowed it to successfully scale, demonstrating the potential of combining cutting-edge technology with strategic expansion into foreign markets. This case highlights the importance of innovative technologies and robust process management in driving growth.

New Insights from the 2024 European Scaleup Monitor

The 2024 edition of the European Scaleup Monitor, which was recently presented at the annual European Scaleup Conference at Luiss Business School and attended by Iceventure, featured additional examples of European companies that have successfully scaled their businesses across various industries.

- Flying Basket: A pioneering startup based in Italy's South Tyrol region, Flying Basket designs and operates multicopter drones for heavy payloads. Founded in 2015, the company scaled by forming strategic partnerships and engaging with regulatory bodies to gain legitimacy. Flying Basket's drones are designed for industrial logistics, and significant investments from entities like Leonardo and venture capital firms underscore its growth potential.

- Hoorcentrum Aerts: The story of a mature business, 21 years old. This Belgian hearing center chain expanded from a single location to 43 centers across Belgium. By emphasizing a global mindset and standardized processes, Hoorcentrum Aerts demonstrated the power of operational efficiency and strategic expansion in the healthcare sector.

- Wallbox: Founded in 2015 in Barcelona, Wallbox has become a leader in EV charging solutions. The company initially focused on residential charging solutions and quickly gained recognition for its innovative products. With significant funding rounds and continuous product development, Wallbox scaled across different markets, forming strategic partnerships and enhancing operational efficiencies. Wallbox now operates in over 80 countries with more than 200,000 charging points installed globally.

Other notable scaleups include Nearfield Instruments, specializing in microscopy technology for the semiconductor manufacturing industry. The company scaled focusing on R&D, sustainability, and waste management, providing answers to questions that some chip producers may not even realize they have.; SiPearl, a French DeepTech scaleup, is advancing Europe’s technological sovereignty with high-performance microprocessors for AI inference and supercomputing by integrating a focused HR strategy from an early stage; Aerogen, a global medical device company that has significantly grown by focusing on innovative drug delivery solutions and expanding its global presence; and Code for All, enhancing digital literacy through scalable software solutions, now reaching over 100,000 users globally.

These examples confirm our experience. They also illustrate that scaling is not industry or technology determined and comes in many forms and shapes.

Decoding different Paths to Scaling

Scaling in Europe? Challenging, but doable. Do these success stories share common patterns? Absolutely.

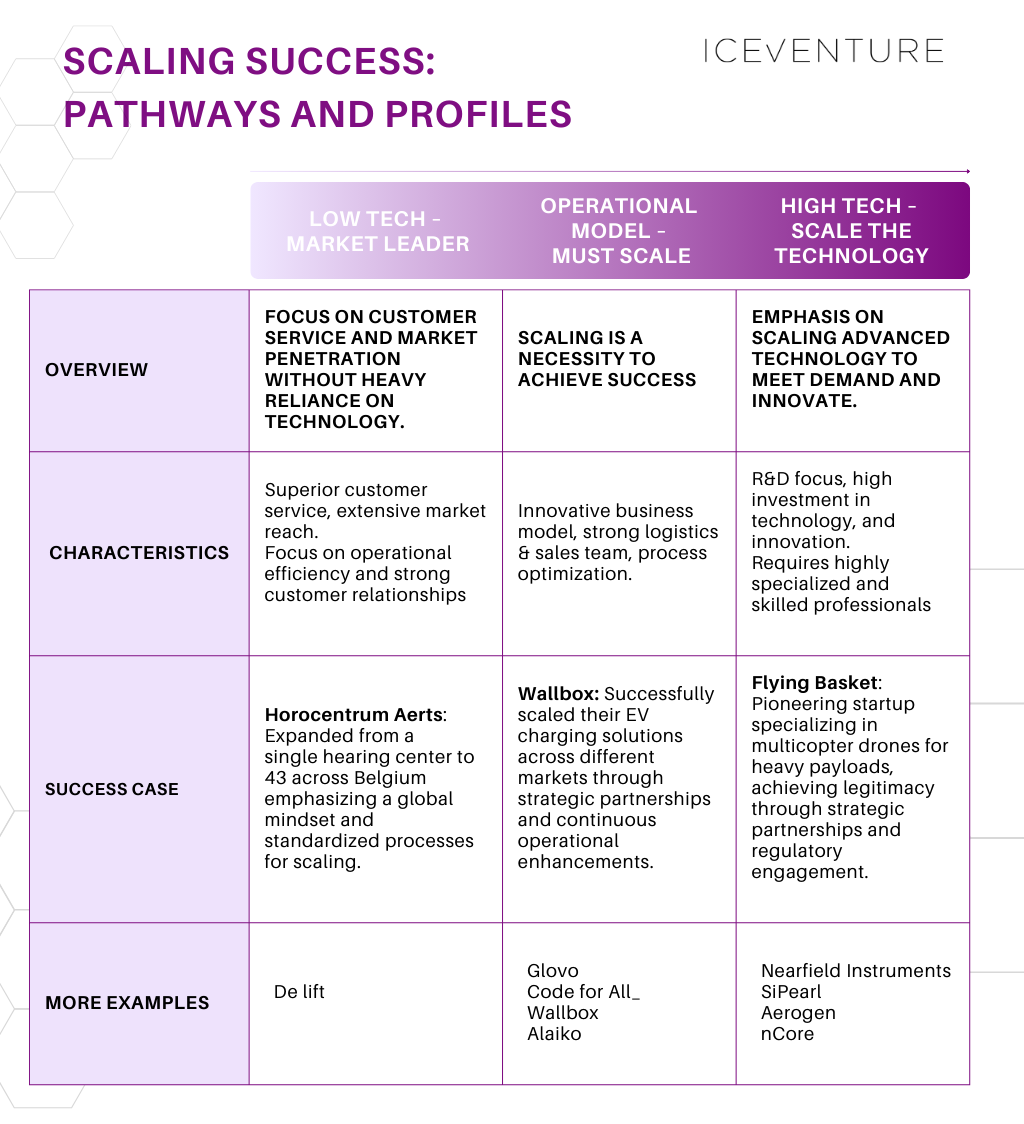

Despite differences in company maturity, market, culture, and organizational structure, the examples presented can be categorized into three distinct scaling profiles:

Low Tech – Market Leader

These scalups excel in customer service and market penetration without heavy reliance on technology. They are often found in more traditional industries. Examples include De Lift, which emphasizes hiring and training enough skilled technicians to offer a comprehensive maintenance service, and Hoorcentrum Aerts, which is focused on ensuring superior customer service and operational efficiency. For these companies, it is generally effective to focus on building a strong brand presence, forging strong customer relationships, and ensuring exceptional customer service.

Operational Model – Must Scale

For these organizations, scaling is necessary to achieve success. Examples include Wallbox, which has formed strategic partnerships and enhanced operational efficiencies, and Glovo, known for its blitzscaling strategy. Both have leveraged strategic partnerships and operational enhancements to scale rapidly.

High Tech – Scale the Technology

Emphasizes scaling advanced technology to meet demand and drive innovation. Examples include Flying Basket and nCore, which focus on product-market fit before scaling, high investment in R&D, recruiting top talent, and maintaining a focus on quality.

Of course, the three categories offer only a guideline and categorization. As experienced strategic business developers we recommend to mix the elements for a unique scaling proposition of an individual business. But getting the category right can provide many strategic benefits.

Why is this classification relevant for startups and companies that want to scale?

One thing is clear: scaling is a complex phenomenon. Scaleups vary greatly in size, shape, and color, with scaling needs that are uniquely tailored to their specific business models and market demands. Understanding the different paths to scaling is crucial for startups and companies looking to expand. Recognizing whether your startup or SME fits into the Low Tech – Market Leader, Operational Model – Must Scale, or High Tech – Scale the Technology categories can guide strategic decisions, helping to optimize your approach to growth. Tailoring your growth strategies to match your organizational profile not only enhances scalability and operational efficiency but also ensures sustainable progress.

About Iceventure

Iceventure, now headquartered in Rome as of 2024, is a niche entrepreneurial consultancy specializing in strategy consulting, business development, innovation, and business intelligence. Our team advises clients across Germany, Italy, the EU, and globally, employing a networked consulting approach critical for the 21st century. This approach integrates detailed sector analysis, global market insights, and an understanding of value creation, supported by our team's extensive experience across finance, innovation, startups, and various industries.